Filing Season is Underway!

The Latest

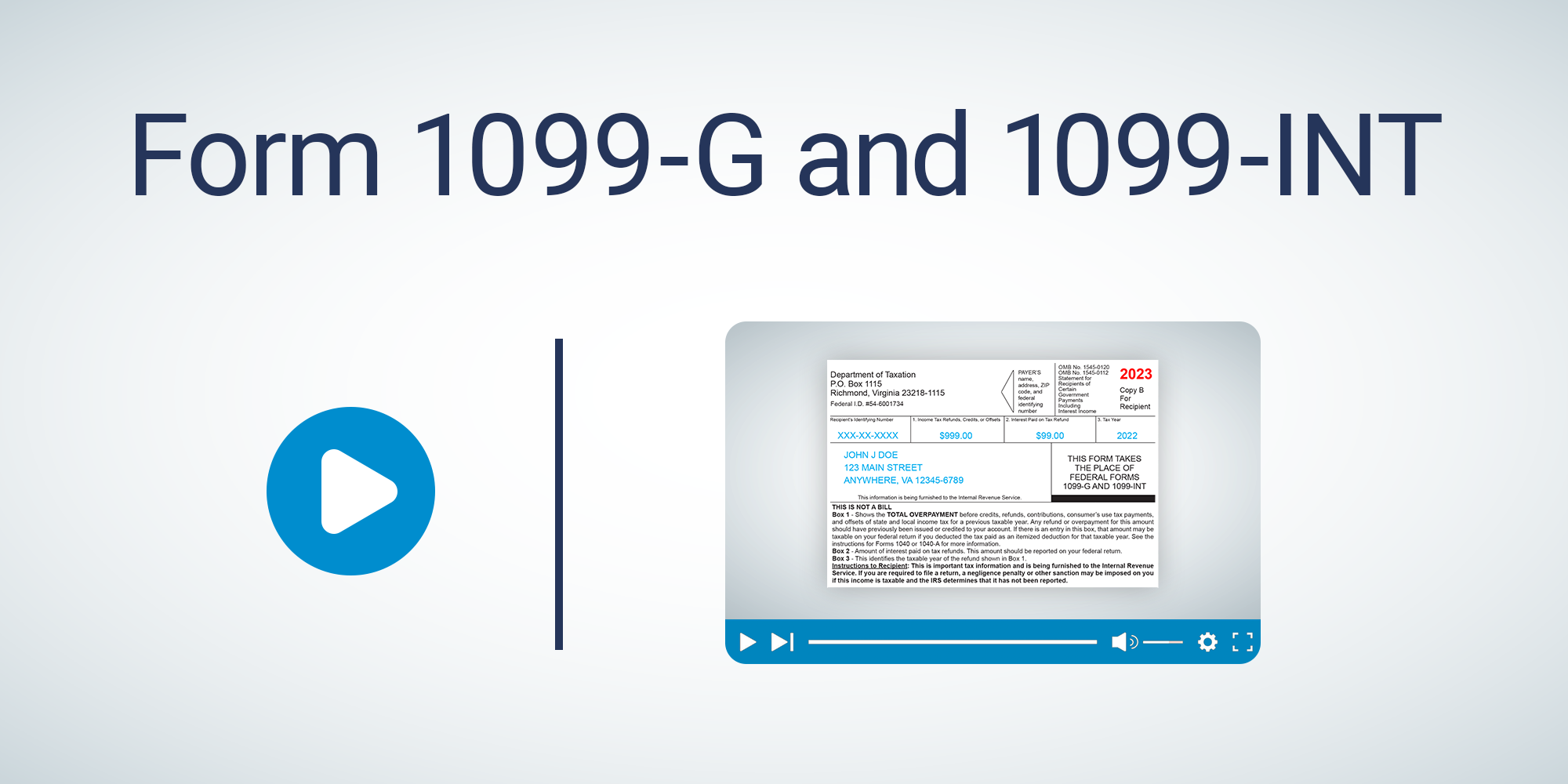

1099-G/1099-INTs Mailed and Available Online

Did you receive a 1099-G and 1099-INT form from us in the mail? Wondering what it means? Or do you need to look yours up online? Either way, we’re here to help! Read More

Litter tax due May 1

If your business is registered for litter tax, you'll need to file and pay the tax by May 1. Read More